My anti Dave Ramsey Debt Path

As of today I’ve paid off around $20,000 of debt. I still have $5,000 of debt left to go but it will be paid off in 3 months.

I didn’t cut off everything completely.

I still bought lattes.

I still dyed my hair.

I still bought clothes.

I did things that were “forbidden” in the debt pay off world. When I went on my debt paying journey I was wondering why I always felt like shit reading or watching other financial gurus.

I thought I was supposed to be inspired or motivated to finally pay off my debt but most times I would just leave their content.. feeling like an asshole for getting into debt in the first place.

I thought.. there has to be a better way to talk about debt.

The steps to get to being debt free are pretty straightforward that we all know:

make more money or cut back on expenses use the rest of the money to pay off debt.

BUT WHY AM I NOT PAYING OFF DEBT?!

Why do I feel so ashamed of my debt that I didn’t even want to look at it?? Let alone call into a talk show and tell them how much debt I had so they can tell me I’m an idiot.

I couldn’t find anyone that talked to my emotions around debt.

I couldn’t find someone who was like let’s talk about how this debt is making you feel or why you got into it in the first place?

Or other questions like.. how am I going to replace my spending habits with positive habits that don’t revolve around me spending money?

When I went on debt pay off journey I told myself that I was going to approach it from what I needed. I needed way more emotional talk, mindset work, and self love around debt than I did a kick in the financial butt.

I tried the financial butt kick stuff, it just didn’t work for me.

Here’s my Dave Ramsey Rant:

I do think Dave Ramsey’s baby steps work and they’ve helped so many people, it just wasn’t what I needed to hit my goals.

He’s been very successful at helping lots of people pay off debt, buy homes, pay off student loans, and generally become financially better.

Here’s a couple things I do disagree with him about:

credit cards are the devil:

Dave seems to throw this idea out there that you should cut up all your credit cards but HELL NAW.

Credit Cards are actually these amazing things that can be used as tools to create MORE money. When they are used in the way where you say.. fuck you banks, I’m making money, that’s when things get fun.

You get money back and percentages off everything you buy OR you get points to fly across the country OR you get a higher percentage off that shirt at that cute store.

But when you’re using them as an emergency money and not able to pay off the debt, that’s when the banks fuck you! We can’t be having that.

I just finished watching this awesome break down of credit card debt on Money Explained on Netflix, definitely watch it if you want to know the healthy way to use credit cards.

There’s even a Youtuber that shows you how he uses credit cards to his advantage and has been able to done the most CRAZY things with his credit card points.

a $1,000 emergency account doesn’t work

I love this idea and what it’s purpose is. The whole point of an emergency account is to stop you from building debt but my problem is with the amount. A $1,000 emergency account really isn’t enough for the average American to have. I always suggest having a 3 month savings account.

If you lost your job or your business crashed tomorrow would $1,000 sustain you even through a month?

Probably not. That’s why you’ll get to debt!

Having a 3 month savings account is what will get you through those true emergencies happen and if you’re an entrepreneur like me, a 6 month savings account is ideal.

pay off your mortgage

This is 1 thing I see a lot of people putting down as a financial goal and I cringe every time I see it, because it’s SUCH. A. WASTE. OF. MONEY.

What if it was possible for you to pay off your house AND make a shit ton of money on top of that?

No really!

Instead of taking all the money you have and dumping it into your mortgage. You can dump that money to index funds and make a 7% return on your money.

By the time that money has grown and compounded it will allow you to pay off your mortgage AND make more money. (This applies when your mortgage rate is below 7%. If it is above 3%, this won’t work).

Here’s how the math breaks down:

Let’s say you have $250,000 left to pay down on your mortgage and your loan has a 3% interest rate, you’re going to pay off your mortgage in the next 10 years.

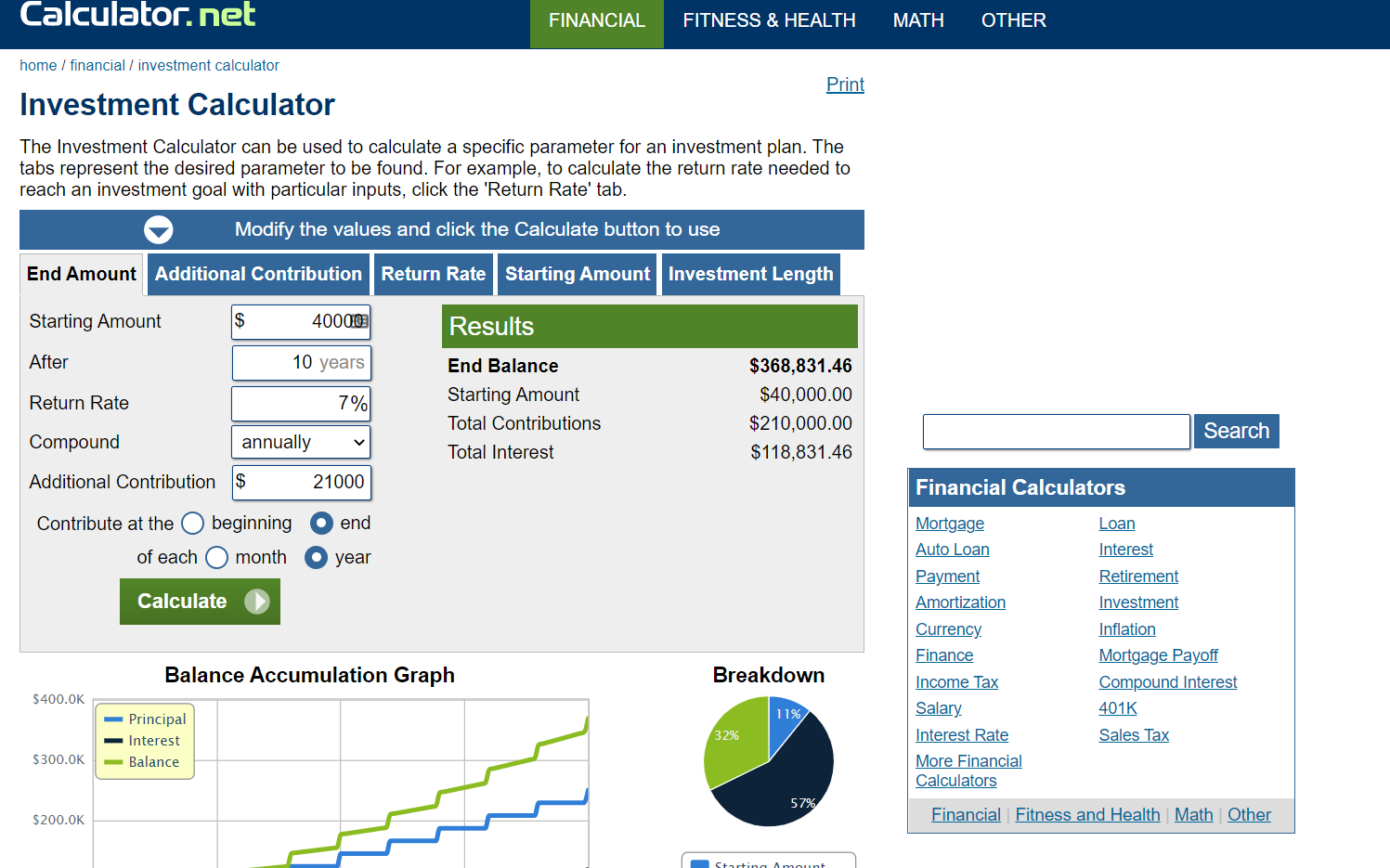

For this example: you dump $40,000 in to start your fund instead of dumping it in your mortgage and over the next 10 years you contribute $21,000 every year. Instead of putting that extra money to your mortgage.

Instead of putting all that money to the mortgage you put into a VTWAX or VTSAX fund instead (index funds), here’s how this will play out:

Instead of having a paid off house that just sits there and only will give you a return when you sell the house.

In 10 years you will have:

a paid off house

an extra $118,831 DOLLARS

and you’ll be able to make money from selling your home

Okay let’s look at this from another angle:

But Shannon I’m only going to throw extra money at the mortgage monthly, I don’t have anything to dump into index funds right now.

What does that look like in 10 years? If for the next 10 years you invested $2,000 extra a month into index funds instead OF putting that money to your mortgage you’re still left with:

a paid off house

an extra $100,000

and you’ll be able to make money from selling your home (as long as the market is good)

Want to see this broken down further?

Check out my financial case study for my client who was interested in paying off her mortgage and why I advised her not to:

In the end here’s the deal: If you would feel better not having a mortgage payment every month then that is totally fine BUT I think it’s important to point out here what you will be missing.

If you know the whole picture and still agree to do things with your money, that is totally okay.

But Dave should totally present this other option so people KNOW what they are missing and they can make those choices for themselves.

cut your retirement contributions to pay off debt

WHAT? For the love of god no. Dave I’m going to use one of your giphs to express my displeasure at this statement.

I know what it feels like to have things that you want to do right now, but changing your retirement plant to pay off debt is losing money. Retirement is something that we all need to be aware of and save for. We have to think of the future us and how they’re going to need WAY more money than we think or are saving.

You might even be thinking: Well if my 401K is giving me 7% on my money but my credit card APR is 14%, it would seem like it would make sense to pay off the credit card first.

BUT you’re forgetting about 401K annual caps.

Every year you’re only allowed to put $20,000 as an employee. It varies from self employment and could cap at around $50,000 depending upon how your LLC and business is structured.

For example: this year you want to pay off $10,000 in credit card debt. Now instead of putting away $20,000 this year, you’re only putting away $10,000. That means you lose this whole entire year to contribute to your 401K.

Instead of making 7% return on $20,000 which = $1400

You’re now only going to end the year with $700.

Now this might not seem like a big difference or a big deal. BUT in 10 years, this money will be at 2 very different points.

If we just looked at how $20,000 + $1400 compounds over 10 years = $42,097.04

$10,000 + $700 compounding over 10 years = $21,048.52

I’m not saying by any means: don’t pay off your debt.

The smart thing here would be to pay off things that AREN’T building you more money.

Paying off debt is a wealth building activity BUT do it without touching this VERY IMPORTANT wealth building asset.

Cut the things in your budget that AREN’T wealth building.

For example: Think about getting a car that is more affordable. Cars are money sinks, they make you no fucking money.

If you have a really expensive car, sell it and buy a used Toyota Corolla.

Use the extra money that you would put towards car payments and put that towards your debt.

Don’t cut out the things that are MAKING YOUR MONEY FOR FREEE.

not going into a restaurant until your debt is paid off

Dave’s famous thing is to say you should only be eating rice and beans until your debt is paid off.

That’s the quickest way to get me to run from paying off my debt.

Sacrifice and discipline are incredibly important in paying off your debt. There isn’t a way to do it without doing one of these but maybe it doesn’t have to be so extreme. I still wanted to enjoy over priced coffee and eat out at restaurants. But there were other things that I cut out to fit these in.

I stopped getting manicures weekly and saved them for special occasions.

I stopped getting my hair done at a fancy salon and started using box dye that I actually love!

I stopped buying new clothes weekly and instead bought a couple staple pieces once in a while.

There was a definite change in my spending habits but there wasn’t a complete loss of fun and life in my budget either.

I don’t believe that making someone cut out all fun or leisure in their budget is the best way to get them to pay off debt, it is the quickest way to get them to stop paying off debt and go back to their old spending habits.

Here’s what did work:

getting honestly real with myself about why I was in debt in the first place

what was I scared of by becoming debt free? what were the negative consequences to becoming debt free?

creating positive habits that helped me to feel good that didn’t involve spending money

instead of using Dave Ramsey’s baby steps I found what felt really good to me was to get rid of the debt that made me feel shitty first instead of tackling the one with the highest APR or the smallest debt. When I started tackling the debt that felt cringe when I saw it on my credit card statements, it felt like a total relief to see that debt go down first.

Seeing where my money could be going: instead of just paying down debt

Creating a 3 months savings account instead of just the $1,000 emergency account before paying off debt

In the end you know what ONLY MATTERS? You finding a way of managing your money that helps you to pay off debt, become wealthy, and save money. Whether it’s the way I paid off debt or Dave’s baby steps, find the way that works for you.

There really is no 1 fits all approach to finances because we’re all so different.

Let me know down below: Are you a Dave Ramsey fan? Has his stuff worked or not worked for you and if so why not?